Overview

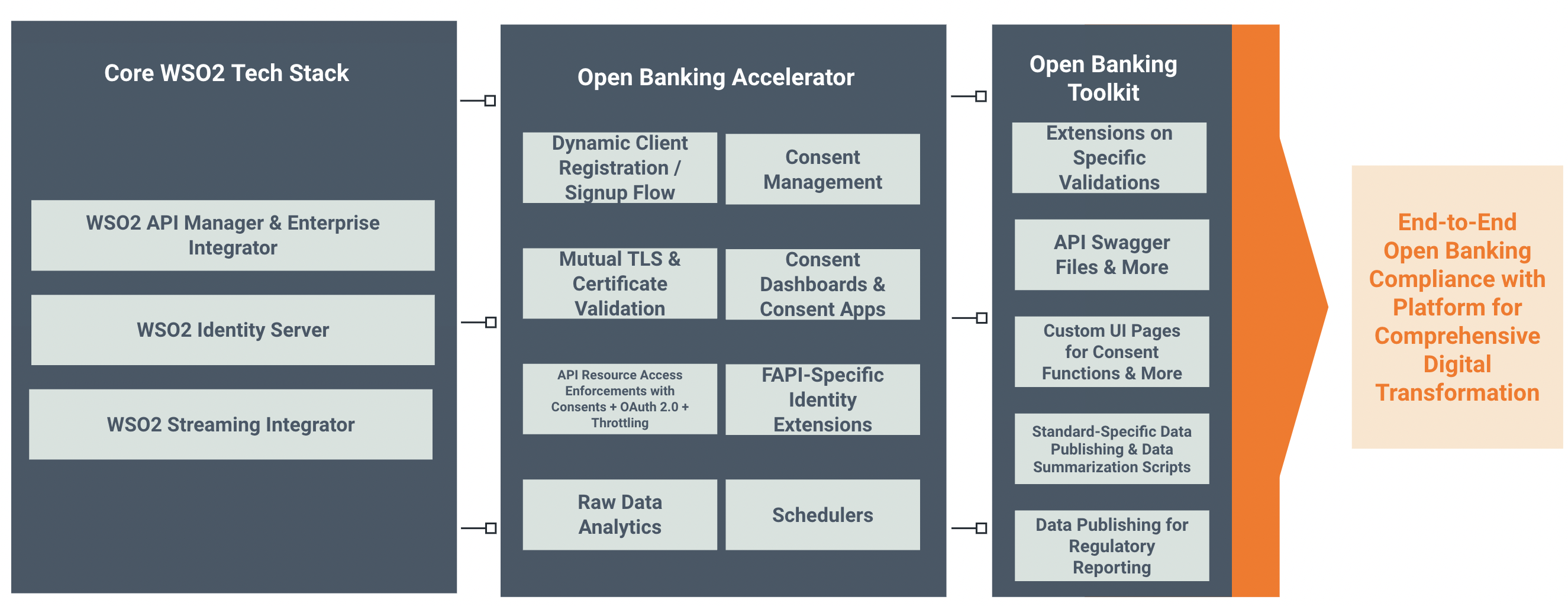

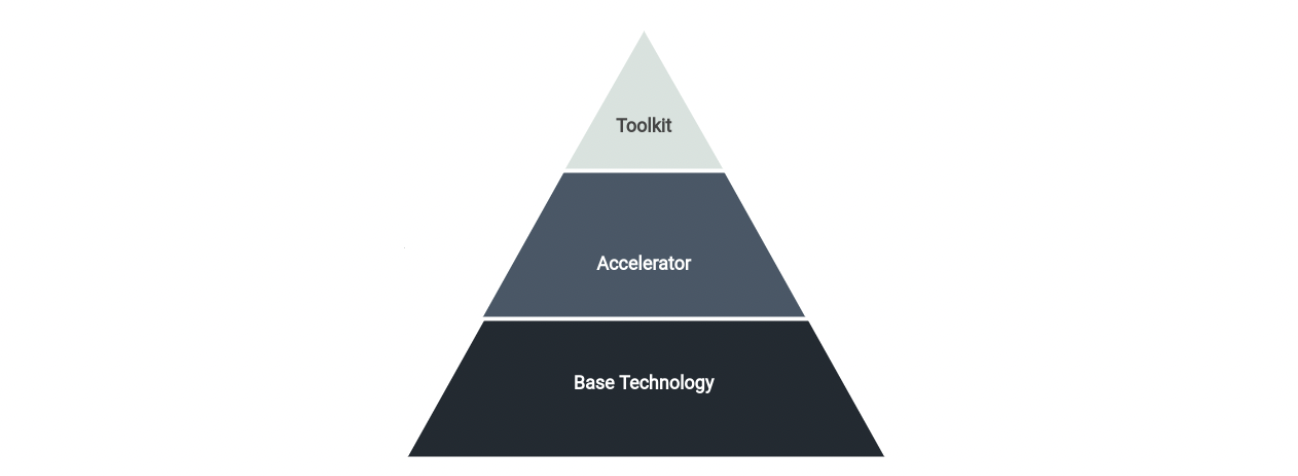

WSO2 Open Banking Accelerator is a collection of technologies that increases the speed and reduces the complexity of adopting open banking compliance. Instead of building a solution from scratch, you can use WSO2 Open Banking Accelerator to meet all legislative requirements with additional benefits beyond compliance. The accelerator runs on top of WSO2 Identity Server and WSO2 API Manager.

The accelerator mainly addresses the open banking requirements such as API consumer application onboarding, consent management, and access authorization among numerous other features to set up an open banking solution. You can easily implement a toolkit to customize the accelerator and help you comply with any regional open banking standard.

Capabilities

Open banking provides a great opportunity for financial institutions to reinvent their legacy systems using fast-developing technologies. WSO2 Open Banking Accelerator delivers comprehensive technology and strategic consultancy to help you execute standards-compliant, commercially successful open banking initiatives.

Regulatory Compliance

- Supports all major open banking requirements defined by open banking regulations

- Use the Open Banking Accelerator extensions and implement a toolkit

- Complies with multiple Security and Functional Conformance Suites

API Consumer/TPP Onboarding

- Register OAuth 2.0 clients with authorization servers

- Provide Dynamic Client Registration (DCR) API

- Validate if the application is authorized by a competent authority

- Validate information such as the role of the application, signature algorithm, authorization scopes, OAuth2.0 grant types, application type, and the request issuance time

- Allow registered applications to access data via open banking APIs

- Extend the DCR services and perform custom validations

Consent Management

- Store, validate, and revoke consents

- Securely expose consent data through an API

- Provide in-built consent management user interfaces for customers and bank staff

- Manage the entire consent life cycle

- Extend the consent management services and customize

Consumer Authentication

- Support Multi-factor Authentication (MFA)

- Support identifier-first authentication

- Adaptive authentication

- Extend the existing authenticators or write new authenticators

Integration

- Easy integration with core banking systems

- Support for different message protocols (HTTP/TCP), message types (REST/SOAP), and formats (ISO 8583, ISO 20022)

- Mediation between the bank’s library of open banking APIs and a legacy or digital core and other banking systems

API Security

Built-in support for global industry standards such as

- OpenID Connect Financial Grade API (FAPI)

- OAuth 2.0

- Electronic Identification and Trust Services (eIDAS)

Data Analytics

- Mediate between the bank systems and modern analytics systems

- Monitor user patterns and behaviours and identify fraudulent activities

- Generate reports and summaries for regulatory requirements

- Support HTTP, gRPC, or any other data-publishing protocol

Dev Portal

- Application developers can publish, republish, subscribe, and test APIs

- Customizable Developer Portal

Premium APIs and Monetization

Using the capabilities in WSO2 API Manager, the accelerator allows the banks to

- Publish highly-performant custom APIs for API consumers

- Expose their performance and compliance data by integrating into analytics engines

- Plug in any billing engines with subscription-based freemium, tiered pricing, or per-request pricing