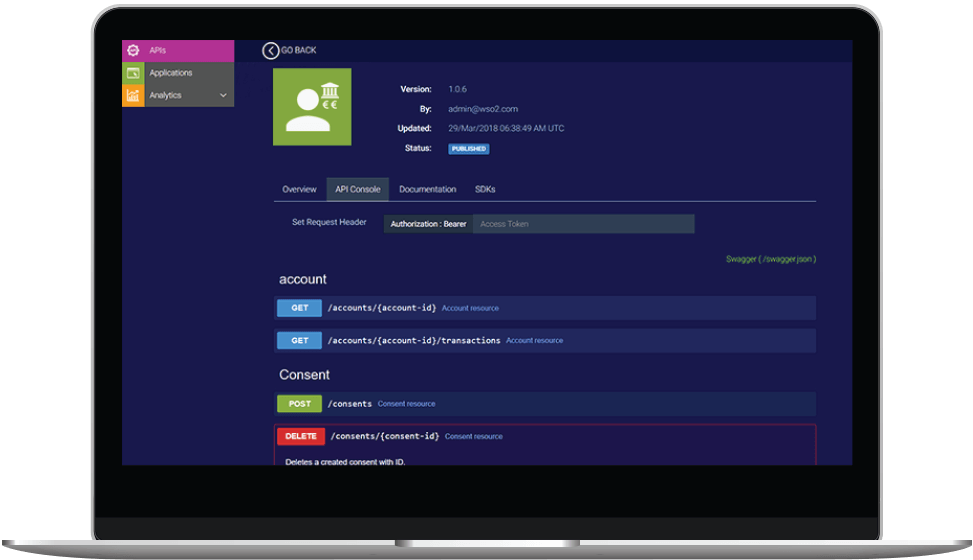

The WSO2 Open Banking Developer Portal Sandbox

This sandbox provides a simulated environment to test the waters of WSO2 Open Banking. It allows users to subscribe and consume APIs from the context of a banking application.

Try it out View guide

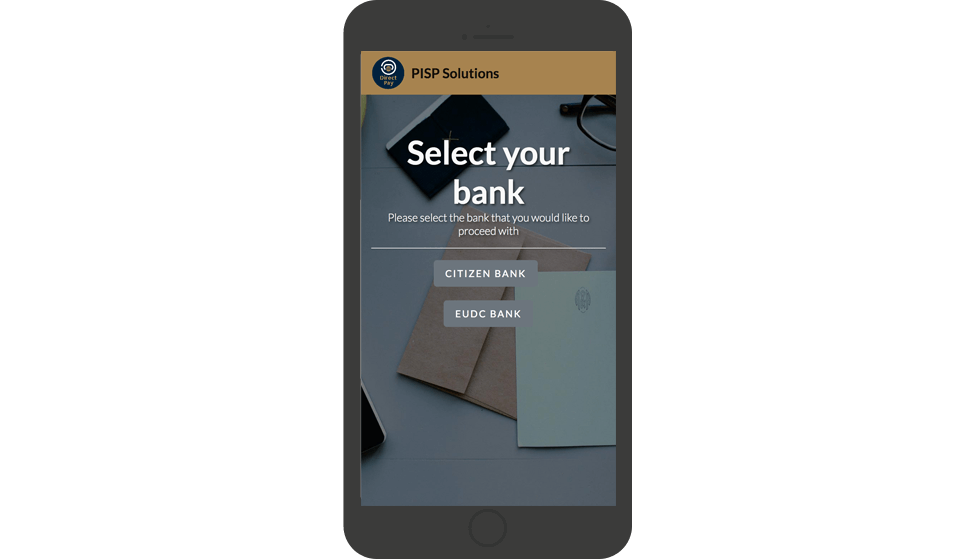

Payment Initiation Service Providers (PISP) Demo

This will demonstrate how our open banking solution interacts in the Payment Initiation Service Providers (PISP) flow of PSD2.

View Demo

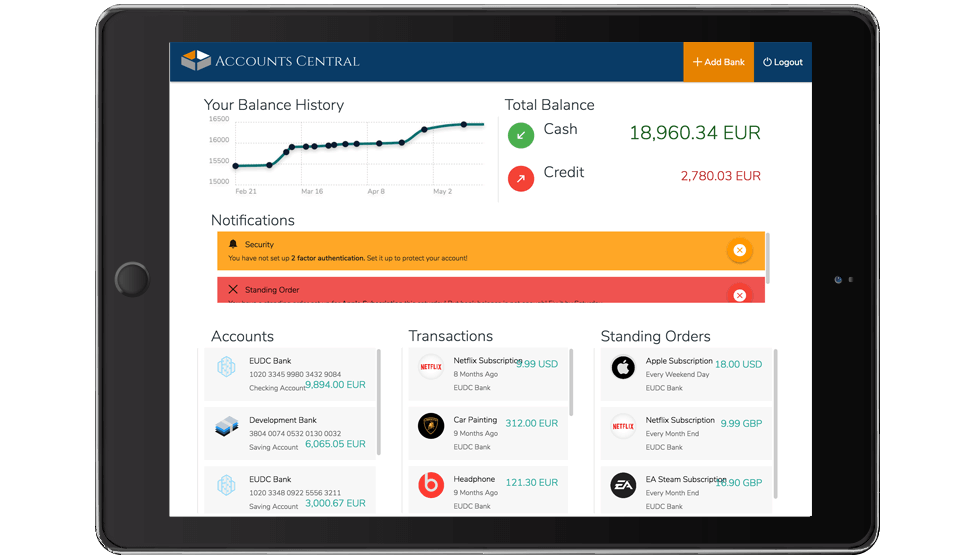

Account Information Service Providers (AISP) Demo

This will demonstrate how our open banking solution interacts in the Account Information Service Providers (AISP) flow of PSD2.

View Demo